Welcome to Student Accounts at

Kalamazoo College!

Billing, Payment Plan and Refunds

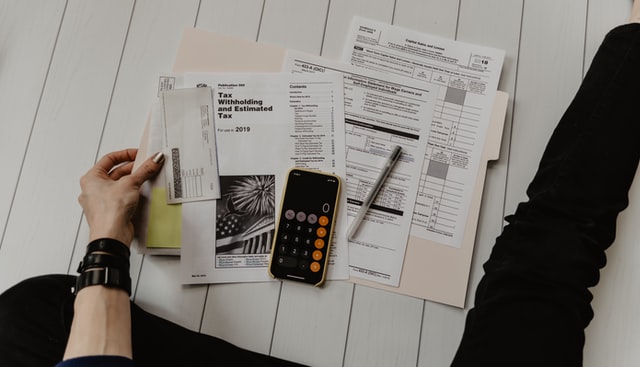

Bills

Fall quarter 2023 bills will be available to students and Parents/Authorized Users the first week of August through the Hornet HQ website. Please note that parents/authorized users must be granted access to view and pay their bills.

Have more questions? Visit our Frequently Asked Questions page for common Billing Policy questions.

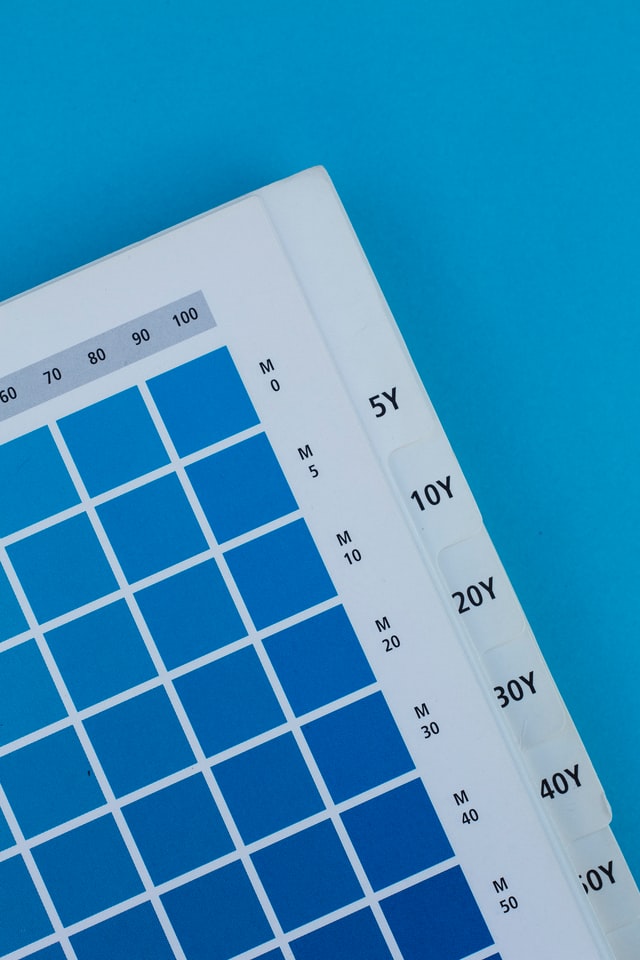

2023-2024 Payment Plan Information

Payment plans for Fall 2023 term will begin in September, Winter 2024 term plans will begin in December and Spring 2024 term plans will begin in March. If interested in the payment plan for the 2023-2024 academic year please signup prior to September 11th to take full advantage of the plan. Returning students need to complete the enrollment process for the payment plan each academic year.

For more information and to sign up visit the Payment Plan Information page.

Please Note: Payment plan applications can only be filled out by students.

Financial Aid Refunds

Credit balances on student accounts will be refunded first week of the term. Refunds for Federal Direct PLUS loans will be mailed out the end of second week. (These funds may be needed for a future term, Please Budget Accordingly.) Kalamazoo College does not use a third-party servicer to process Title IV refunds, nor does it have a banking relationship that qualifies as a “Tier Two” arrangement for processing Title IV refunds.